Nike Stock Plunges: What's Next for the Swoosh?

Nike (NKE) stock experienced a significant downturn in March, falling 20% to a seven-year low, according to S&P Global Market Intelligence. This decline follows disappointing third-quarter fiscal year 2025 earnings and a warning of further deterioration in the fourth quarter. While the company beat analyst estimates for earnings per share ($0.54 versus an estimated $0.29), revenue fell 9% to $11.27 billion, a figure that still surpassed Wall Street's lowered expectations of $11.03 billion. This revenue decrease is attributed to a combination of factors including declining market share to competitors like Deckers' HOKA and On Holdings, weak consumer discretionary spending, and macroeconomic pressures such as tariffs.

The company's gross margin also suffered, falling from 44.8% to 41.5% as Nike attempted to clear excess inventory of classic styles to bolster its full-price strategy. Management forecasts a further 14% revenue decline in the fourth quarter, with a projected gross margin drop of 400 to 500 basis points. Despite these challenges, Nike's running segment showed renewed growth, driven by strong demand for the new Pegasus Premium, and the company reported growth in Japan and Latin America, offsetting an overall decline in the Asia-Pacific Latin America region.

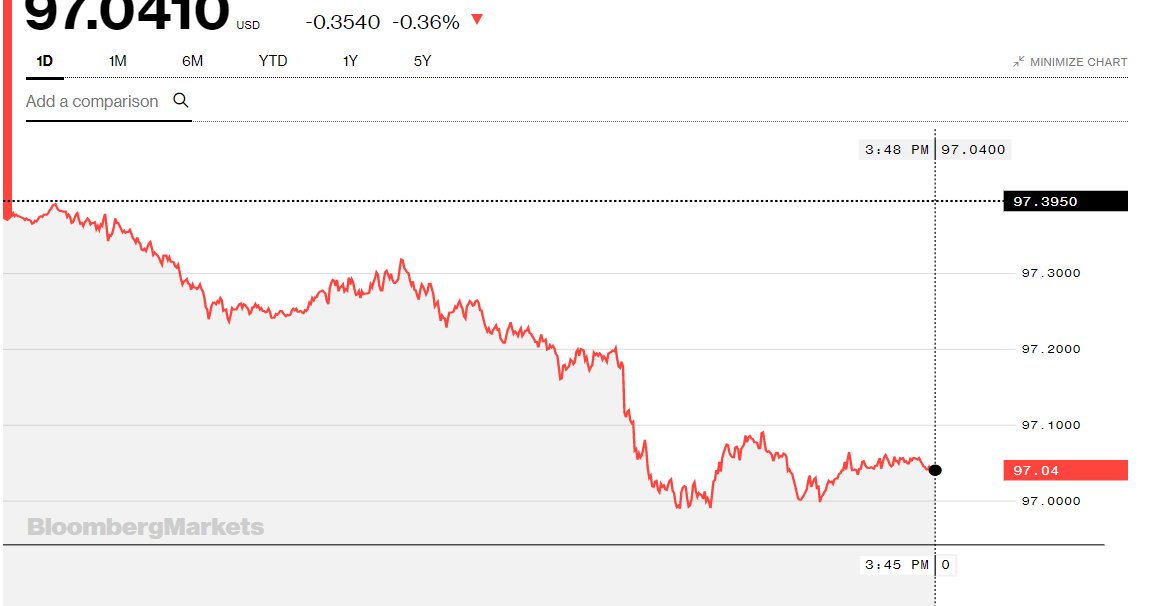

The stock's year-to-date performance is equally concerning, showing a 16.4% drop as of Friday, closing at $63.17 – a price last seen in January 2018. This represents a dramatic 64% fall from its November 2021 high of $177.51. In contrast, competitor Adidas has seen a 74% stock price increase since January 2023, fueled by a new CEO and a successful resolution to its legal dispute with Ye. Nike's CEO, Elliott Hill, who returned to the company in October 2024, aims to revitalize the brand through innovation and stronger retailer relationships. While analysts offer mixed opinions, with ratings ranging from "hold" to "buy," and price targets varying significantly, the consensus rating stands at "Moderate Buy" with a $87.38 price target according to MarketBeat.com. Despite the current challenges, Hill remains optimistic about Nike's long-term prospects, emphasizing the company's continued dominance in basketball and its strong roster of sponsored athletes.