Gold Soars to Record Highs Amid Tariff Uncertainty

Gold prices reached record highs this week, fueled by investor anxieties surrounding President Trump's unpredictable tariff policies. On Tuesday, gold futures briefly touched a record $3,177 per ounce before a slight pullback, yet still remain over 18% higher than at the start of the year, contrasting sharply with the S&P 500's over 4% decline during the same period. The surge is attributed to a flight to safety as markets react to Trump’s escalating trade war, which is expected to increase consumer prices and create further uncertainty for businesses and investors. This uncertainty is also stoking fears of a potential US recession.

The president's announcement of further tariffs, dubbed "Liberation Day," has only amplified existing market concerns. Analysts at Bank of America predict gold prices could reach $3,500 per ounce within the next 18 months, citing tariff-related fears as the primary driver of the recent surge. Michael Widmer, head of metals research at the bank, noted that while gold prices have been gradually rising for years, the current spike is almost exclusively due to this uncertainty. Despite the upward trend, experts caution about gold's inherent volatility.

While gold's appeal as a safe haven asset is undeniable, Lee Baker, CEO of Claris Financial Advisors, highlights potential downsides. Unlike stocks or bonds, gold doesn't offer dividends or interest, meaning profits depend solely on price appreciation. Furthermore, physical gold ownership presents storage and security challenges. Baker advises against investing in gold solely due to its current hype, emphasizing the importance of diversification.

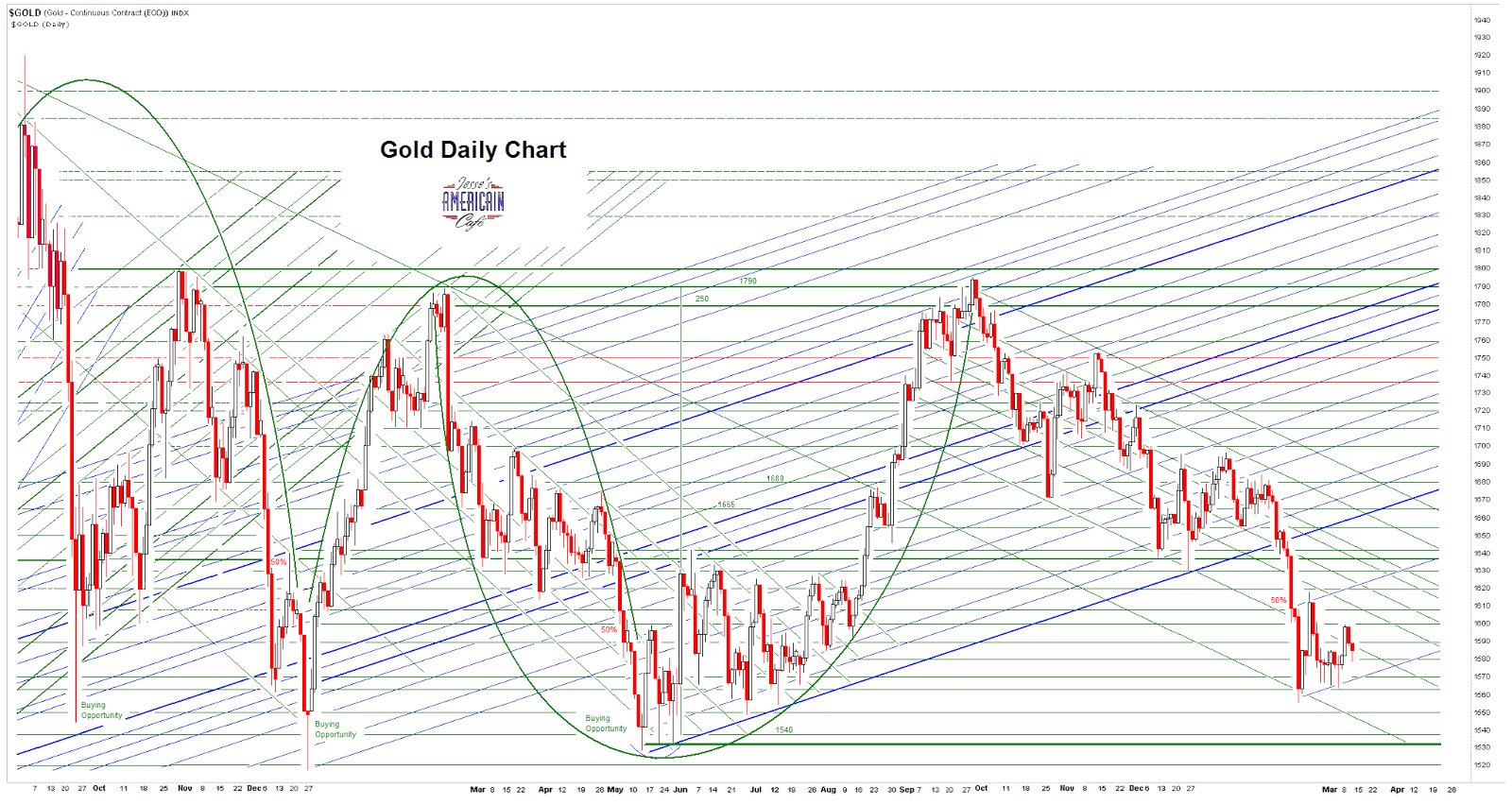

Technical analysis suggests potential short-term consolidation. An intraday reversal on Tuesday formed a shooting star candlestick pattern, a bearish indicator. However, bar pattern analysis projects a resumption of the uptrend later this month, potentially reaching $3,395 by late May. Crucial support levels to watch include $3,048, $2,953, and $2,858. Despite the potential for short-term profit-taking, the relative strength index (RSI) indicates bullish momentum. One metals trader, Tai Wong, highlighted the aggressive nature of the reciprocal tariffs, predicting further asset market selloffs and a weaker dollar, supporting a short-term gold price target of $3,200. Other analysts, such as Peter Grant of Zaner Metals, also anticipate further price increases, with potential targets of $3,300 and $3,500. Spot gold reached $3,129.46 per ounce on Wednesday, while U.S. gold futures settled at $3,166.20.